50+ what percentage of your income should be mortgage

Web While you can qualify for a mortgage with a debt-to-income DTI ratio of up to 50 percent for some loans spending such a large percentage of your income on debt might leave. Ad Compare Home Financing Options Online Get Quotes.

Example Uk Charity Fundraising Budget Template

Web A 15-year term.

. Your DTI is one way lenders measure your ability to manage. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Find A Lender That Offers Great Service.

Ad Afford More Than You Imagined With As Little As 10 Down On Mortgages Up To 3M. Get an idea of your estimated payments or loan possibilities. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web Calculating a mortgage payment and determining what percentage of your income your mortgage should be is a calculation called debt-to-income ratio. Ad Compare Home Financing Options Online Get Quotes. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

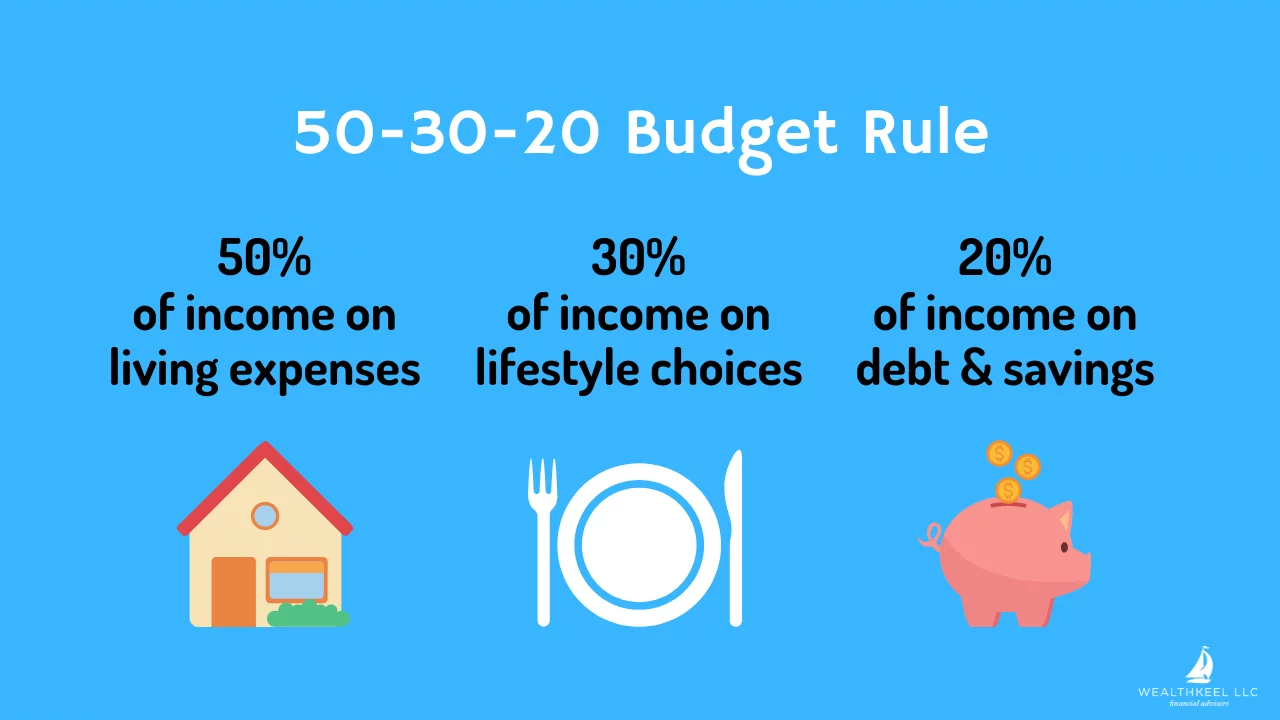

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your. Try our mortgage calculator.

Ad Compare Best Mortgage Lenders 2023. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Compare More Than Just Rates.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Dont Settle Save By Choosing The Lowest Rate.

Lets say your total. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Lock Rates For 90 Days While You Research.

Web Q Im interested to know what the recommendations are regarding what proportion of our net monthly income should be going on mortgage payments. 2 To calculate your maximum monthly debt based on this ratio multiply your. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

Get Your Home Loan Quote With Americas 1 Online Lender. Track your monthly spending to see what percent of income you spend on each of the budget. Web Having a monthly budget helps you understand your financial capabilities.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Apply Online Get Pre-Approved Today. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Get Your Home Loan Quote With Americas 1 Online Lender. John in the above example makes. Ad Calculate Your Payment with 0 Down.

Affordability Index Mortgage Broker Tools

High Yield Landlord Marketplace Checkout Seeking Alpha

Los Angeles Is The Whole Foods Of Rental Markets A Renter Households Spend Nearly 50 Percent Of Their Income On Rent Dr Housing Bubble Blog

:max_bytes(150000):strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

401 K Contribution Limits For 2022 And 2023

Should The Rbnz Increase The Ocr By 25 Or 50 Basis Points Interest Co Nz

Here S How To Figure Out How Much Home You Can Afford

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

At What Age Do Most People Retire In America Financial Samurai

What Percentage Of Income Should Go To A Mortgage Bankrate

Utah Careers Supplement For Workers Over 50

50 Student Money Saving Tips Stretch Student Loans Mse

What Lower Mortgage Rates Mean For Buyers And Sellers Embrace Home Loans

How To Cut Expenses And Reduce Spending Debt Com

Percentage Of Income For Mortgage Payments Quicken Loans

How Much Do I Need To Retire As A Physician Wealthkeel

Read Financial Fragility Report Dec19

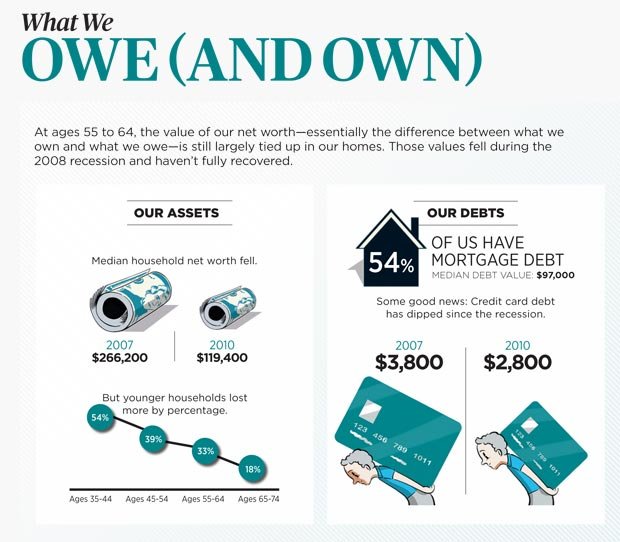

A Pocket Guide To Your Money And Personal Finance At Age 60 Aarp