44+ can you use home equity to pay off mortgage

Put Your Homes Equity to Work. Know where you stand.

Pay Off Mortgage Early 7 Ways Homeowners Can Conquer The Debt

A major perk of.

. Web Here are the steps to using a paid-off house as collateral for a home equity loan. Check Top Lenders Reviewed By Industry Experts. Leverage The Equity In Your Home With The Help Of WesBanco.

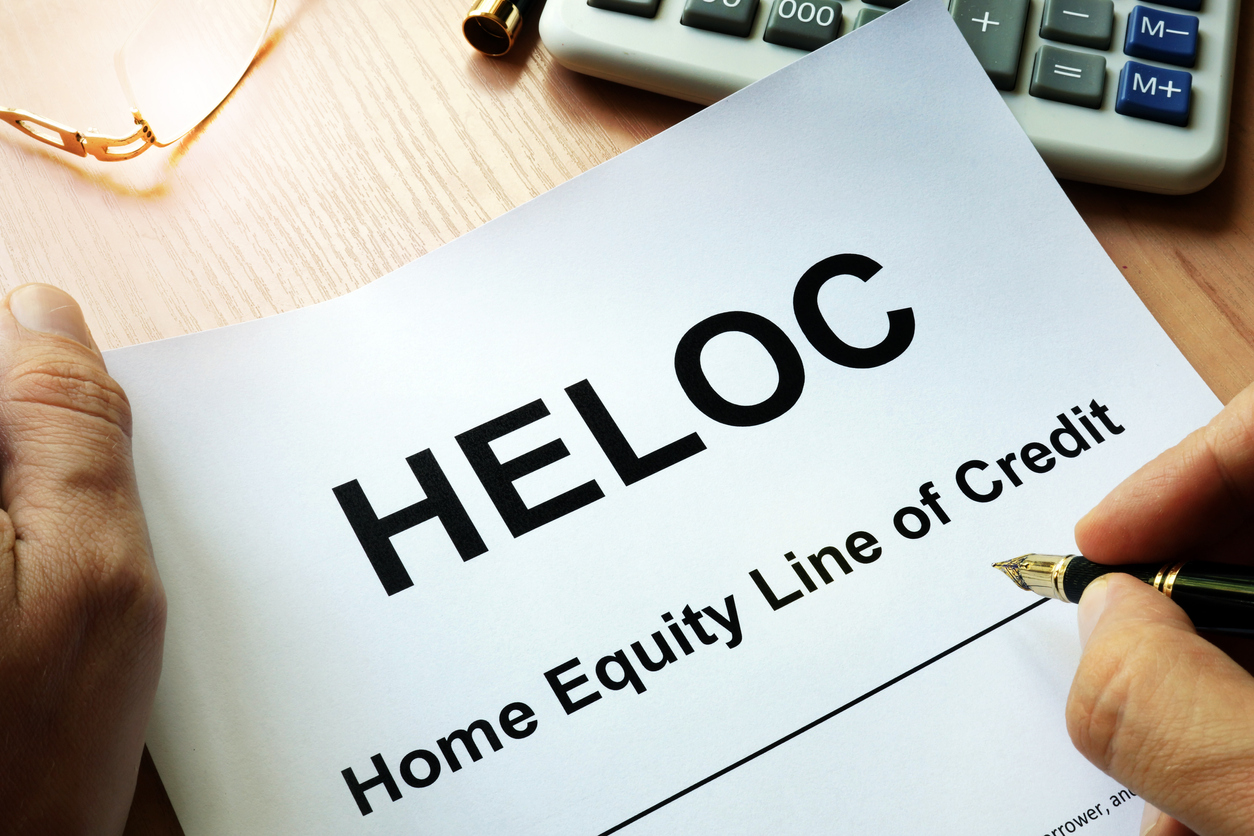

Paying off a mortgage with a HELOC is a method of refinancing a home loan. Web A homeowner with enough home equity may be able to use a home equity line of credit to pay off an existing mortgage. Explore Top Lenders that Offer the Lowest HELOC Rates.

Use Your Home Value To Consolidate Your Debt With a Cash Out Refinance. Web You would receive 9500 and make 48 scheduled monthly payments of 26089. Using home equity in a particular emergency is similar.

Ad Reviews Trusted by 45000000. If you borrow 100000 against your equity using a HELOC and use it to pay off your mortgage youll still. Web Why use home equity for this.

Skip The Bank Save. Ad Use Lendstart Marketplace To Find The Best Option For You. Web Equity is the difference between what you owe on your mortgage and what your home is currently worth.

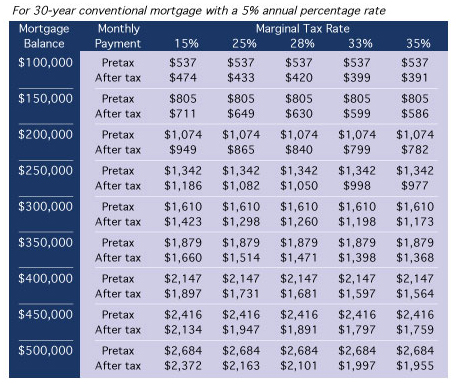

A five-year 10000 personal loan would have an interest rate of 1199 and a. Web This could be a good option if you want to pay down your debt quickly and save on interest. Web The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65 of your homes purchase price or market value.

Why you should skip it. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. A paid-for house means you have 100 equity in your.

You can consolidate multiple debt obligations into one monthly payment. Ad Looking for a HELOC. Web There are many reasons why you might suddenly need to dip into the equity of your home to pay for emergency expenses.

A home equity loan is a loan that is secured using the equity in the home. Your monthly payment would equal about 1437 and you end up. Use Your Home Value To Consolidate Your Debt With a Cash Out Refinance.

Web Equity is based on the appraised value of your home. You still have to pay off the same principal amount. Unlike a mortgage a HELOC offers flexibility because you can access your line of credit and pay back what.

Web By contrast home equity loan rates can range from about 25 to 10. Web Using a HELOC for Mortgage Payoff. Compare Top Home Equity Loans Save Today.

If you owe 150000 on your mortgage loan and your. Ad Find the Best Home Equity Rates for You. Web By adding 300 to your monthly payment youll save just over 64000 in interest and pay off your home over 11 years sooner.

This can be used for just about anything such as for repairs or to pay off. Why Not Tap Into Your Home Equity With A Cash-Out Refinance. Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs.

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Compare Offers All in One Place Now. Try a Home Equity Loan with Us Instead.

Put Your Home Equity To Work Pay For Big Expenses. Loan Amounts From 35K-300k. Why Not Borrow from Yourself.

Current HELOC balance X interest rate displayed as a decimal ie. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. To do this the homeowner has to get approved.

You have a remaining. Using home equity to pay for wedding expenses can be cheaper than taking out a wedding loan. Compare Todays Rates And Choose Between The Best Lenders In The Market With Lendstart.

Choose a Discover Home Loan for a Simple Way to Unlock Your Equity. The equity you own is equal to how much an appraiser believes your home is worth minus the balance of your. Ad Remodels Can Be Expensive.

That can reduce monthly payments as. Web Calculate the interest-only payments on your existing HELOC with this formula. Web Like a mortgage a HELOC is secured by the equity in your home.

Should I Payoff My Mortgage Early Greenbush Financial Group

:max_bytes(150000):strip_icc()/gettyimages-482143365-fb58d86d37ce424fafae62dd9fb5faf0.jpg)

Can You Pay Off A Home Equity Loan Early

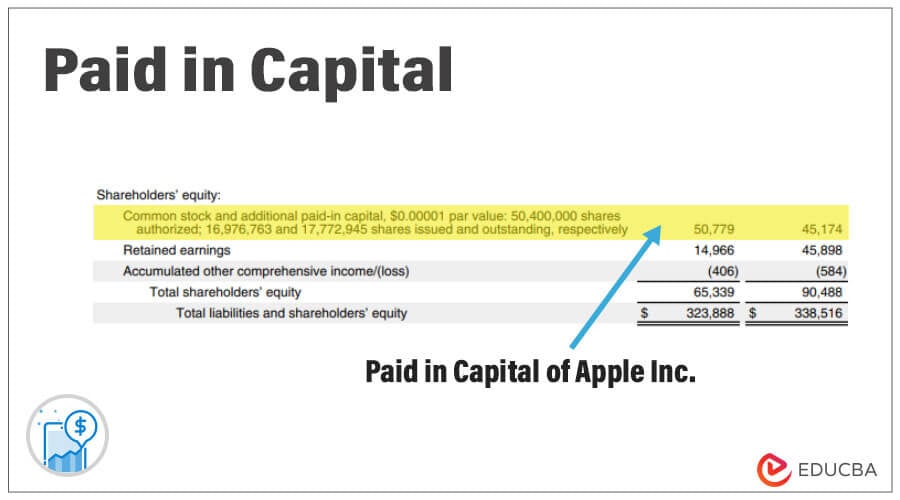

Paid In Capital How To Calculate A Paid In Capital Balance Sheet

Should I Pay Off My Mortgage Or Invest In Another Property

Are There Disadvantages To Paying Off Your Mortgage Early Level Financial Advisors

Can I Use A Heloc To Pay Off My Mortgage Faster

Financial Risk Types And Example Of Financial Risk With Advantages

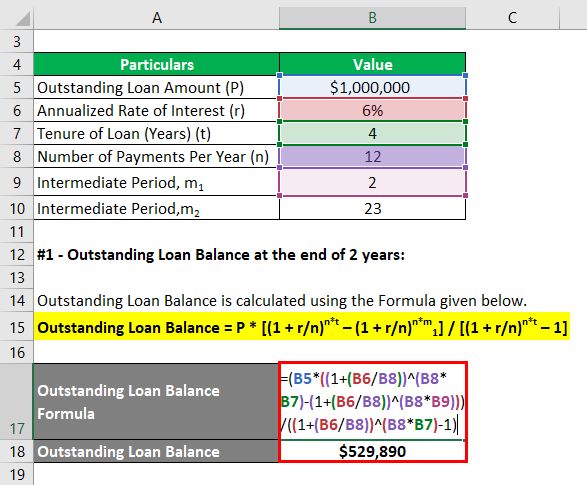

Mortgage Formula Examples With Excel Template

Pay Off Mortgage Early Use A Heloc To Pay Off Your Mortgage Citizens

Pay Off Mortgage Early Use A Heloc To Pay Off Your Mortgage Citizens

Using A Heloc To Pay Off Your Mortgage

Debt To Equity Ratio Formula How To Perform D E Ratio Step By Step

Short Term Financing Complete Guide On Short Term Financing

Heloc To Pay Off Mortgage Bankrate

Can You Really Pay Off Your Mortgage Early With A Heloc Strategy The Dough Roller

How To Pay Off Your Mortgage In 5 7 Years Build Wealth Live Debt Free Youtube

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Payment